GlobalFoundries revenue increased 56 percent YoY as chip demand persists

The big picture: GlobalFoundries for the third quarter ending September 30, 2022, generated $one.7 billion in revenue, up five percent sequentially and 56 percent higher than the $1.09 billion earned in the twelvemonth-ago period. The outlook is fifty-fifty rosier for the holiday quarter every bit unprecedented demand for chips continues.

The report included $5 1000000 in profit compared to a $293 million loss in Q3 2022. Earnings per share checked in at $0.01, or $0.07 on an adjusted basis. Analysts surveyed by FactSet expected $1.seven billion in revenue and a small loss.

Tom Caulfield, CEO of the semiconductor contract manufacturer, said acquirement growth was primarily driven past higher wafer output and product diversification.

Shares in GlobalFoundries are trading down one.18 percent as of writing at $68.53, which is still roughly 45 pct college than its opening price of $47 back in late October.

GlobalFoundries has had a busy 2022. Over the summer, rumors surfaced claiming Intel was exploring an acquisition of the company for an estimated $30 billion. Executives quickly shot down the scuttlebutt, doubling down on plans to movement forward with an initial public offering. The company fabricated good on its hope a few months afterwards and today, has a market cap of more than $36 billion.

Looking ahead, GlobalFoundries expects revenue to reach $ane.8 billion to $i.83 billion in the quaternary quarter, with turn a profit to range from $13 meg to $33 million. Earnings per share could be anywhere between $0.02 and $0.06, or $0.09 to $0.13 on an adjusted basis.

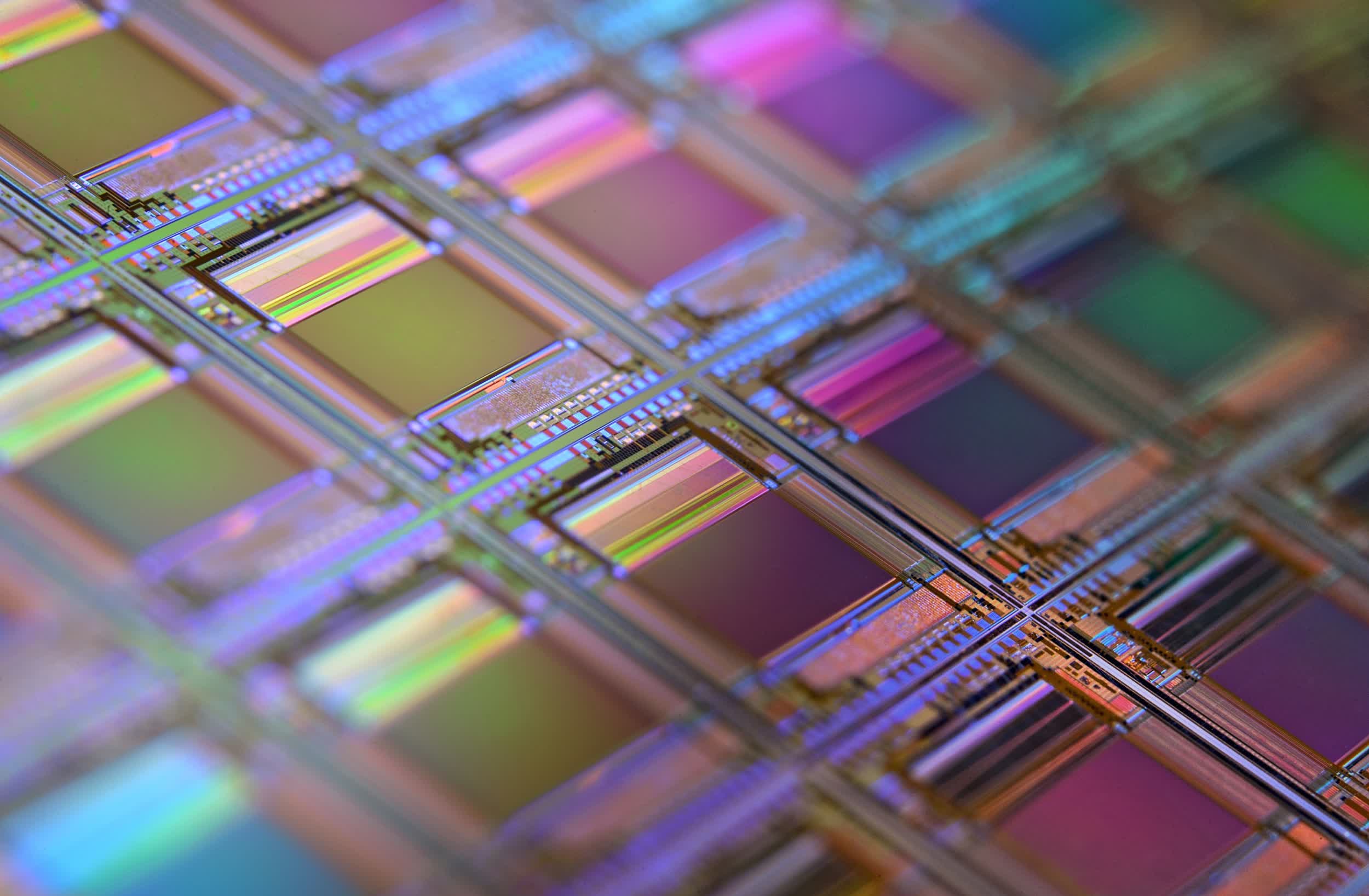

Image credit Laura Ockel

Source: https://www.techspot.com/news/92452-globalfoundries-revenue-increased-56-percent-yoy-chip-demand.html

Posted by: beckhamknestagave.blogspot.com

0 Response to "GlobalFoundries revenue increased 56 percent YoY as chip demand persists"

Post a Comment